Is Gambling Income Subject To Se Tax

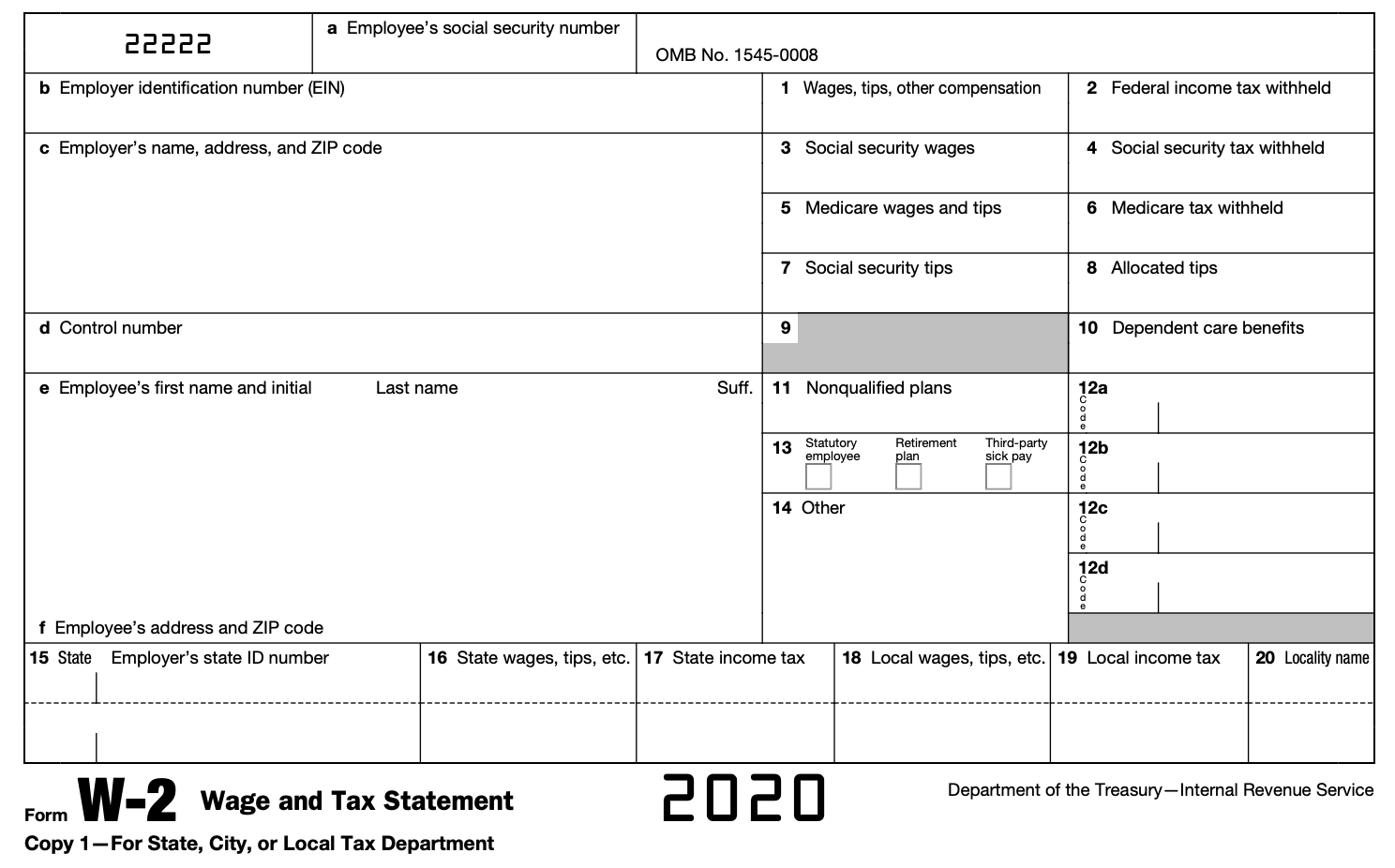

Yes, whether you gamble at land-based or online casinos, the money you earn is subject to federal income tax. Known as gambling income, the money you earn from wagers and bets as well as lotteries, sweepstakes, etc. All must be taxed. In some cases, you will be provided with tax forms that must be turned in to the federal government. Gaming income is taxable like any other income you receive throughout the year. Whether or not you receive a W-2G from the casino, it is your responsibility to report “earned” winnings on your personal income tax form. As it does for land-based gamblers, the same applies to online casino players.

If your sales total $1 million but you have to pay $200,000 in rent, $100,000 for your employees and $500,000 for the widgets to sell, your income subject to self-employment tax is only $200,000. So, in the above examples, John has $40,000 in gambling income on his MI-1040 and pays $1,700 in tax and Joan has $4,000 in gambling income on her MI-1040 and pays $170 in tax even though both John and Joan had overall gambling losses. To get around this unlucky result, the strategy is to use gambling losses to directly offset gambling income.

More Articles

When you work as an employee, your employer withholds the employee portion of your Federal Insurance Contributions Act taxes -- the Medicare and Social Security taxes -- from your pay, and pays the rest herself. When you're self-employed, you're subject to self-employment taxes instead. These equal the total of both the employer and employee portions of the FICA taxes. As of 2013, that's 12.4 percent for Social Security and 2.9 percent for Medicare. However, if your self-employment income is less than $400 for the year, you don't need to pay self-employment taxes.

Earned, Non-Employee Income

Self-employment tax hits your income from doing work when you're not an employee. This includes income from working as an independent contractor, sole proprietor or partner in a partnership. For example, if you work for a law firm as an associate, you're an employee of the law firm so your wages are hit with FICA taxes, not self-employment taxes. But, when you make partner, you're now a part owner in the business so your income counts as self-employment income, not employee income.

Deductions

When figuring how much of your income is hit with the self-employment tax, Uncle Sam allows you to first deduct all of your related business expenses. These can include advertising, vehicle expenses, business insurance, interest on business loans, attorney fees, office rent, supplies, wages for your employees and the cost of goods you sell. For example, say you sell widgets. If your sales total $1 million but you have to pay $200,000 in rent, $100,000 for your employees and $500,000 for the widgets to sell, your income subject to self-employment tax is only $200,000.

Unearned Income Excluded

Income Subject To Fica Tax

Unearned income, such as stock sales, interest, dividends, and gains on selling your home or other real estate are generally not subject to self-employment taxes. However, if you're a dealer in a particular type of goods, income from that is subject to self-employment tax. For example, say that you flip houses regularly. Since you're a dealer in real estate, your profits on those sales count as ordinary income and are hit with the self-employment tax. Similarly, if you're a stock day trader, your gains and dividends are also subject to self-employment tax.

Accounting Methods

Income Tax Gambling Deductions

When you're self-employed, you can use either the cash method or accrual method for figuring your income. But, if you have inventory, you must use the accrual method. You make your choice when you file your first income tax return for your self-employment income and then must continue to use the same method in the future. The cash method requires you to report income and expenses when you actual receive the money or pay the bills, while the accrual method requires you to report when you have the right to receive income or have incurred an expense, even if you haven't paid it yet.

- Jupiterimages/Brand X Pictures/Getty Images